How Paymento Transforms the Prepaid Card Industry

The prepaid card industry has been evolving rapidly, especially with the integration of cryptocurrency payments. As the market grows, so do the challenges that businesses in this sector face. These challenges range from high transaction fees to security concerns and the complexities of integrating new payment systems. This article explores how Paymento, a non-custodial payment gateway equipped with Buy Now, Pay Later (BNPL) features, can address these issues and transform the prepaid card industry.

Brief Overview of the Industry

The prepaid card industry is booming, driven by the increasing preference for cashless transactions and the convenience of gift cards. According to Allied Market Research, the global prepaid card market size was valued at $1.73 trillion in 2019 and is projected to reach $6.87 trillion by 2027, growing at a CAGR of 18.2% from 2020 to 2027. The integration of cryptocurrency payments into this market is a relatively new but rapidly growing trend, offering unique advantages for both consumers and businesses.

Current Challenges Faced by Businesses in This Industry

- High Transaction Fees: Traditional payment methods often come with high fees, cutting into profit margins.

- Security Concerns: Protecting sensitive customer data from breaches is a significant concern.

- Integration Complexity: Adding new payment systems can be complex and costly.

- Global Accessibility: Expanding reach to a global market is challenging due to varying regulations and payment systems.

- Customer Trust: Building and maintaining trust in a digital environment is crucial

These challenges are not only relevant to individual businesses but also reflect broader market issues that can impact overall industry growth and consumer confidence.

Paymento: A Game-Changer for Prepaid Card Providers

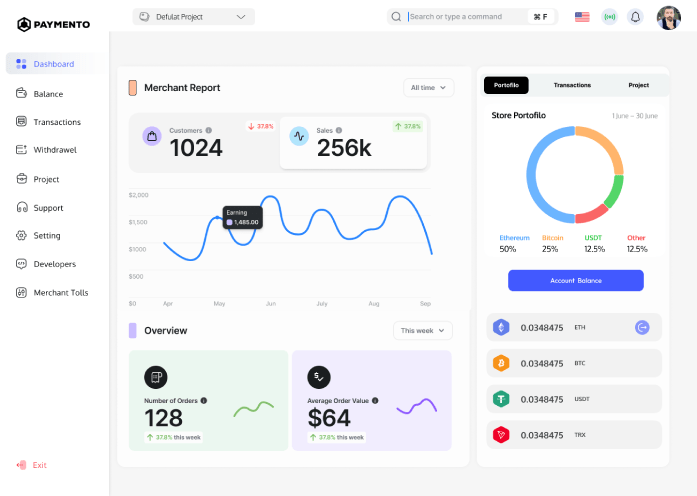

Paymento is a DeFi-based, fully non-custodial crypto payment gateway that stands out with its innovative features:

Non-Custodial Structure: Ensures no sensitive transaction data is stored, enhancing security.

Low Transaction Fees: Reduces costs by eliminating intermediaries.

BNPL Feature: Offers flexibility to consumers, allowing them to buy now and pay later.

Global Reach: Facilitates international transactions without the usual barriers.

How Paymento’s Non-Custodial Payment Gateway Works

Paymento empowers merchants to turn their wallet into a merchant account, without relinquishing control of their funds to a third party. This structure not only reduces costs but also mitigates the risk of data breaches.

Specific Scenarios in the Prepaid Card Industry

1. Reducing Transaction Fees

Challenge: High transaction fees are a significant burden for prepaid card providers, especially for cross-border transactions.

Solution: Paymento’s decentralized system facilitates direct peer-to-peer transactions, drastically cutting down on fees.

Enhancing Data Security

Challenge: Data breaches are a constant threat, with centralized systems being prime targets.

Solution: Paymento’s non-custodial model ensures that no critical data is stored, significantly reducing the risk of breaches.

Expanding Global Reach

Challenge: Navigating different payment systems and regulations worldwide is complex and costly.

Solution: Paymento’s decentralized nature allows seamless international transactions, bypassing many regulatory hurdles.

Payment Integration Complexity

Paymento provides a seamless API integration by adding a few lines of codes and also supporting no-code integration for most popular shopping carts.

Using Gift Cards and Prepaid Cards to Convert Crypto to Fiat

In many countries where cryptocurrencies are not recognized as legal tender, consumers face challenges in spending their crypto directly. However, buying gift cards and prepaid cards with crypto can be an effective workaround. Here’s how:

• Practical Solution: Gift cards and prepaid cards can be purchased using cryptocurrencies and then used as fiat currency for various purchases.

• Increased Accessibility: This method allows consumers to convert their crypto into a spendable form, even in regions with strict crypto regulations.

• Enhanced Flexibility: Paymento’s integration with gift card and prepaid card providers enables consumers to seamlessly convert and spend their crypto without legal hurdles.

Conclusion

Paymento is transforming the prepaid card industry by offering a secure, low-cost, and inclusive payment solution. By leveraging DeFi protocols and a non-custodial structure, Paymento addresses key industry challenges such as high transaction fees, data security concerns, and the risk of user bans. The benefits of integrating Paymento include reduced costs, enhanced security, increased sales, and global accessibility.

Paymento’s innovative features and ease of integration make it an ideal choice for businesses looking to modernize their payment systems and expand their customer base. Experience the future of prepaid card solutions with Paymento. Sign up today and transform your payment systems with secure, low-cost, and globally accessible crypto payments. Get started with Paymento.