Why Most Crypto Payment Platforms Fail at Decentralization (And How Paymento Fixes It)

Do any of you remember when Bitcoin first came out? The pitch was pretty simple and promised a world without banks, chargebacks, or frozen accounts. Yet, fifteen years later, most “crypto payment” platforms still run exactly like banks holding users’ funds, collecting KYC data, and controlling the rails they claim to free us from.

The irony is clear: DeFi talks decentralization, but the checkout button often leads right back to a centralized database. At Paymento, we set out to fix this. We built a fully non-custodial, wallet-to-wallet payment infrastructure that keeps the promise crypto made from day one — your funds, your keys, your control.

Where Most Crypto Gateways Go Wrong

1. Custody as a Convenience Trap

To simplify operations, many payment platforms hold customer funds temporarily. It speeds up reconciliation but re-introduces risk, frozen balances, withdrawal delays, and potential compliance overreach.

Paymento never holds merchant or user funds. Our API only facilitates blockchain interaction and confirmation, the transaction itself lives entirely on-chain.

2. Off-Chain Shortcuts

Some gateways “optimize” by settling payments off-chain, maintaining internal ledgers instead of blockchain transactions. That saves gas but removes transparency — and once you depend on an internal database, you’re back to trusting a middleman.

3. Centralized Data Control

Many “crypto” platforms still collect unnecessary personal data under the excuse of analytics or fraud protection. We designed Paymento’s system to require only minimal technical metadata for payment tracking, no KYC for merchants, no customer profiling.

Why True Decentralization Is So Hard

Building real decentralization is challenging for two main reasons: technical complexity and business trade-offs. Running blockchain nodes for multiple networks is resource-heavy and costly. Many gateways cut corners by relying on centralized RPC providers.

Fraud protection and volatility management are easier with centralized controls but they come at the cost of freedom.

User experience suffers when transactions depend on multiple wallets or slow confirmations, so most companies add intermediaries to “smooth it out.”

Paymento’s approach was different. We engineered a modular microservice architecture that monitors blockchain transactions directly across multiple networks without ever taking custody of funds. It’s harder to build. But it’s the only way to stay true to Web3’s ethos.

How Paymento Aligns With Decentralization Principles

1. Non-Custodial by Design

Every transaction goes from the payer’s wallet directly to the merchant’s wallet. Paymento’s servers verify blockchain events and send confirmations — but they never have access to private keys or balances.

Think of Paymento as a trustless bridge, not a vault.

2. Wallet-to-Wallet Settlement

Our payment flow is based on observation, not intervention. When a user pays, the transaction is broadcast to the blockchain, and Paymento simply listens for confirmations to notify both sides. This architecture ensures that merchants are in full control of their funds from the moment payment is made.

3. Payment Link and Invoice Infrastructure

Our Payment Link and Invoice systems are powered by Paymento’s API, not by on-chain smart contracts. They serve as the infrastructure layer that makes non-custodial payments easy to use, generating dynamic payment addresses, tracking confirmations, and handling notifications while keeping all funds on-chain, in the user’s wallets.

It’s the same philosophy as Web3 itself: the interface is centralized for convenience, but the value layer remains decentralized.

4. Privacy-Preserving Architecture

Paymento stores no sensitive customer data. We only log transaction hashes, payment IDs, and non-identifiable technical metadata for status updates. You keep your identity, funds, and transaction control — we simply provide the rails.

The Infrastructure That Makes It Possible

- Multi-chain node connectivity (Bitcoin, Ethereum, Solana, Tron, and more)

- Blockchain listeners that monitor payment confirmations in real-time

- API-driven notifications for merchants to automate fulfillment

- Grace and reminder systems for recurring or subscription payments

None of these components take custody of funds — they just make wallet-to-wallet payments practical for real businesses.

How Paymento Differs From Typical “Crypto Payment” Platforms

| Problem with Others | What Happens | Paymento’s Approach |

|---|---|---|

| Custodial Accounts | Funds sit in company wallets until manual withdrawal. | Wallet-to-wallet settlement; funds go directly to merchant. |

| Off-Chain Accounting | Transactions recorded in internal databases. | All payments verified directly from blockchain. |

| KYC & Data Collection | Merchants hand over identity data for compliance. | No mandatory KYC for merchants; minimal metadata. |

| Frozen Balances | Centralized control allows halting payouts. | Paymento never touches funds, so freezing is impossible. |

| “Smart-Contract” Hype | Many claim decentralization but use centralized logic. | Paymento uses APIs to support on-chain transactions transparently. |

Bridging Web2 Simplicity With Web3 Principles

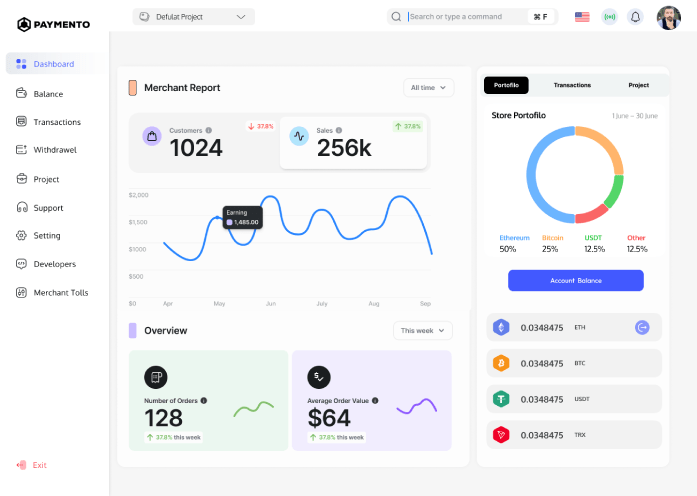

Most businesses don’t want to manage blockchain infrastructure; they just want payments to work. Paymento gives them a Web2-like experience like APIs, dashboards, webhooks without sacrificing Web3 values.

Our system acts as an enabler of decentralization:

- Merchants keep custody of funds.

- Transactions remain on-chain.

- Paymento provides the network logic, not financial control.

This balance between usability and sovereignty is how crypto payments will reach mainstream adoption.

Real-World Use Cases

E-commerce & Freelancers

Accept payments in crypto directly to your wallet, no exchange accounts, no custody delays, no frozen balances.

Creators & Subscriptions

Automate recurring payments with Payment Links that trigger on blockchain confirmations. Paymento manages reminders and grace periods but not your money.

Developers & Integrators

Use Paymento’s APIs to build crypto checkouts, subscription tools, or on-chain billing — while keeping user wallets and merchant wallets in full control.

Why Non-Custodial Infrastructure Matters Now

Recent exchange failures and payment freezes have reminded the industry that decentralization is only as strong as its weakest custodian. For real adoption, merchants need both freedom and functionality and Paymento delivers that by enabling non-custodial commerce.

We’re not replacing the blockchain. We’re building the rails that let everyone use it safely.

The Future of Crypto Payments

Decentralization doesn’t mean every business must run its own node; it means no one can take your funds away. By combining infrastructure reliability with wallet-level autonomy, Paymento bridges the gap between ideology and practicality.

The crypto economy won’t scale through speculation, it will grow through real payments, real ownership, and real independence. That’s the future we’re building.

Final Thoughts

True decentralization requires infrastructure and that’s exactly what Paymento provides. We may not be “decentralized” in the protocol sense, but every transaction we process moves crypto closer to its original purpose: peer-to-peer money, without custody, without compromise.