Accepting Crypto Payments on Your Website in 2025

It’s the age of cryptocurrency, and to keep up with the trend, you need to know how to accept cryptocurrency payments on your website.

Over 15,000 businesses accept Bitcoin worldwide, and the number of global B2B cross-border transactions on the blockchain network is expected to reach 1,767 million in 2025.

This is due to the enormous benefits cryptocurrency offers, such as low gas fees, fast transaction speed, and global inclusiveness. Cryptocurrency adoption is at an all-time high and smart businesses are leveraging it to create new revenue streams.

However, accepting crypto as a payment for goods and services has its pros and cons. You should consider many factors before making this decision because it can positively or negatively impact your business depending on how you approach it.

This guide will help you understand why and how to accept crypto payments, the pros and cons, legal considerations, and common mistakes to avoid.

How Do Crypto Payments Work?

The process of cryptocurrency payment starts when a customer initiates a transaction. They open their digital wallet, input your website-generated address, and enter a specific amount. Then they enter their private key to complete the transaction.

Transactions that are confirmed are sent to a broadcast network of computers called nodes. Once cryptographically verified on the network, the completed transaction is stored as a ‘block’ of transaction and added to the log of existing transactional blocks.

Afterwards, you receive your crypto or converted fiat funds in your wallet.

Why Should You Accept Cryptocurrency Payments in 2025?

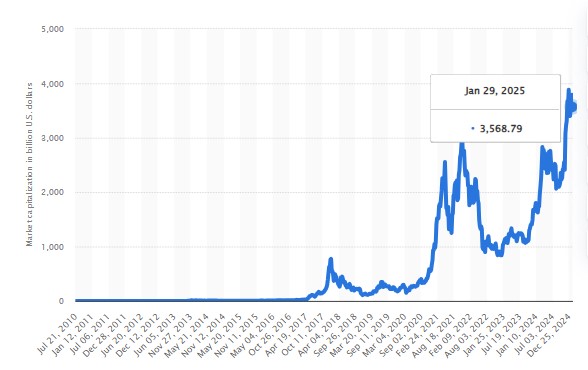

There’s no doubt that cryptocurrency is the future. The cryptocurrency market grew from a $1.54 billion market cap in April 2013 to approximately $3,569 billion in January 2025. Bitcoin dominates the crypto market and has seen massive growth, reaching a market cap of $2000 billion in 2025.

Source: www.statista.com

While it is evident that crypto payment adoption is on the rise, it is also causing controversy worldwide.

Cryptocurrency supporters like Felix Zu stated, “A Trump administration openly supportive of crypto could reduce regulatory uncertainty.” Mark Cuban views Bitcoin as a more satisfactory alternative to gold for long-term investments.

Bill Gates believes that digital currencies can improve the financial landscape. In an interview with Bloomberg, he stated, “Digital currencies can lower the cost of a range of transactions by as much as 90%, providing nearly universal access to innovative financial products and services.”

Warren Buffett however thinks otherwise. He referred to Bitcoin as “probably rat poison squared.”

Amid the crypto commotion, it’s important to understand what crypto offers your business and how best to leverage its benefits. Here are the significant benefits for you:

- Wider customer reach: According to the security.org 2025 crypto adoption report, 67% of cryptocurrency holders are men, and 33% are women, with an average age of 45. Businesses with a target audience outside these age groups should not prioritize crypto payment adoption, as customers will not fully utilize the option. If your business caters to young adults and millennials, accepting decentralized payments expands your customer base to include those who prefer digital payments.

- Instant Payments: Decentralized payments require no central authority. Process payments faster than traditional payments.

- Reduced Transaction Fees: Crypto payments require lesser fees compared to centralized banking.

- Improved Security: Blockchain technology powers cryptocurrency, so payments are decentralized, transparent, and permanently stored.

- Cross-border Transactions: Global transactions are made possible with crypto payments. Excessive centralized regulations that delay international transactions are eliminated, allowing the processing of cross-border transactions in minutes.

Choosing the Right Cryptocurrency for Payments

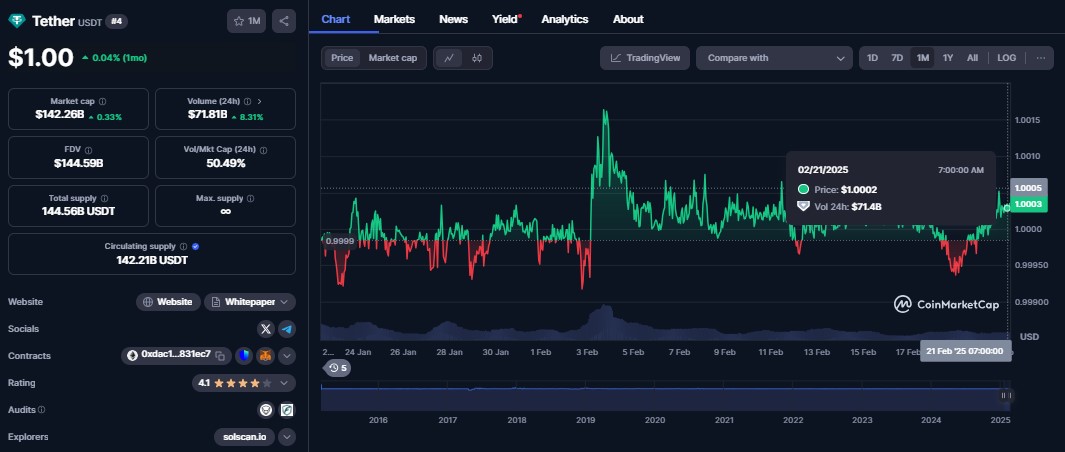

Source: coinmarketcap.com

After you decide to accept digital payments on your website, knowing the ideal cryptocurrencies well-suited for your customers is important.

How fast is the payment processing? Is it accepted globally? What security measures are there? How low is the transaction fee?

The answers to these questions will determine the cryptocurrency suitable for you. In no particular order, here are the top five suitable digital currencies for you to consider for your website:

- Bitcoin (BTC)

Bitcoin dominates the crypto market with the highest market size, users, and global reach. Priced at $98,234 on Feb. 21, 2025, and had a market cap of $1.9 trillion. It is a widely accepted digital currency for payments and is owned by 76% of cryptocurrency holders in 2025.

Bitcoin is the most recognized and demanded payment choice because of its wide acceptance by multiple businesses, liquidity, and reliability.

- Ethereum (ETH)

Ethereum is the most prominent alternative to Bitcoin by market size and is owned by 46% of crypto holders. It is the leading altcoin and focuses on creating smart contracts and decentralized applications to build a financially inclusive space where everyone can benefit regardless of religion, race, age, or nationality.

Ethereum was the pace-setter for other altcoins, trading for $2,654 and having a global market value of $320 billion on Feb. 24th, 2025.

- Ripple (XRP):

The second leading altcoin by market capitalization was precisely $153 billion on the 21st of Feb. 2025 and traded for $2.65. Achieves trust and ensures security with XRP Ledger Consensus Protocol, which doesn’t require proof-of-work or proof-of-stakes.

It is highly flexible and advantageous over Bitcoin and Ethereum, with a superb transaction processing speed of 1500 transactions per second (TPS), compared with Bitcoin’s 7 TPS and Ether’s 15-30 TBS.

This gives it an edge over other cryptocurrencies, increasing its adoption by businesses.

- Solana (SOL):

Popularly regarded as an ‘Ethereum killer.’ Solana is similar to Ethereum in the aspect of building smart contracts, which becomes the foundation for developing decentralized apps (dApps) and non-fungible tokens (NFTs), but it has some advantages over it.

Its transaction speed and fees are second to none. It processes more payments in seconds and charges less fees compared to Ethereum.

18% of cryptocurrency owners currently own SOL, which was priced at $175.73 on February 21st, 2025, and had a global market size of approximately $85 billion.

- Stable Coins (USDT, USDC):

These are the most widely adopted stablecoins whose value is attributed to a fiat currency. USDT, linked to the U.S. dollar, was valued at $1 on Feb. 21, 2025, and has a total market value of $142 billion.

On the same day, the USDC value, also linked with the U.S dollar, was traded at $0.9 and had a market cap of $56 million.

They allow crypto adopters to utilize blockchain technology in trading fiat currencies, reducing high volatility and enjoying stability. This stability gives them preference over other coins as the worry of price fluctuations is eliminated for merchants and customers.

Top 3 Seamless Crypto Payment Gateways in 2025

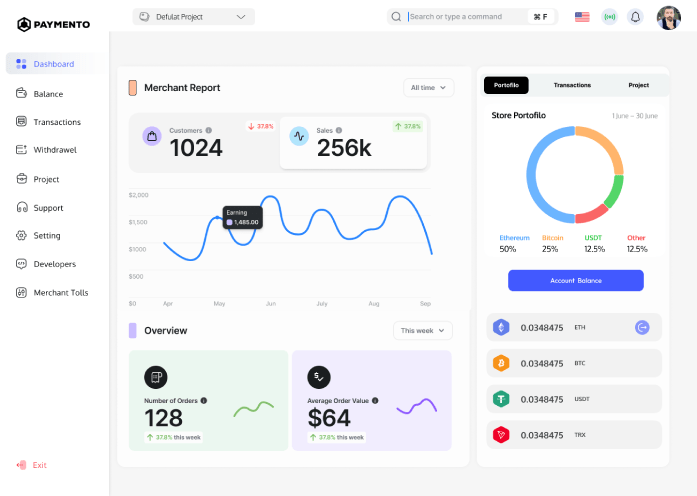

Paymento

Paymento is a non-custodial crypto payment gateway that gives you full ownership and control of your funds. It is perfect for merchants and businesses who own an online store and want a hassle-free checkout integration. It is also ideal for freelancers and companies that want to accept automated crypto-to-fiat payments.

Unlike other online payment gateways, Paymento offers decentralized self-custody wallets. This includes an offline wallet less prone to online hacks for your crypto funds’ safe-keeping.

Here are other key benefits you will enjoy when you choose Paymento for your website:

- KYC-free privacy protection for your funds

- Instant conversion of your crypto funds to your local currency—fiat—and eliminating volatility.

- Offers a free trial that allows you to transfer $20,000 worth of crypto funds without charging any fee. Afterwards, you pay a very minimal fee of 0.5% for transactions.

- Supports over 4000 cryptocurrencies, including the popular ones, so you can receive all your customers’ preferred cryptocurrencies.

- With easy-to-use APIs and plugins, you can seamlessly integrate it into your WooCommerce, Shopify, or WHMCS online store.

Bitpay

Bitpay, one of the best crypto payment gateways, allows you to buy, store, and use cryptocurrencies in one platform. It suits merchants and large businesses that prefer stability over volatility and need frequent crypto-to-local currency conversions.

Here are its significant benefits:

- Provides fast conversion of crypto funds to fiat funds—USD, EUR.

- Implements Two-Factor Authorizations (2FA) and multi-signature wallets.

- Provides invoice services for businesses

- Charges a fee of 1% to 2% (+ 25cent) on transactions, depending on the amount.

CoinPayments

CoinPayments is a secure and trusted payment gateway established in 2013. It supports over 1300 cryptocurrencies with its dedicated wallets and 175 cryptocurrencies for online transactions.

Some of its other benefits include:

- Crypto conversions and charges a network fee between 0.5% and 1% for incoming payments and wallet services.

- Enables secure crypto transactions on iGaming, forex, and e-commerce platforms.

- Provides borderless crypto payment solutions.

- 24/7 customer support

Setting Up a Crypto Payment Gateway in Minutes

Here’s a step-by-step guide for integrating a crypto payment gateway into your website.

- Select a suitable crypto payment gateway that suits your needs.

- Register your account on the platform and follow the recommended steps to verify your account.

- Using either the API or plugin method, integrate the payment gateway into your website.

- Select your preferred digital payment options and customize your dashboard to your satisfaction.

- Include a crypto payment link or checkout option on your website.

- Your customers can now make crypto payments.

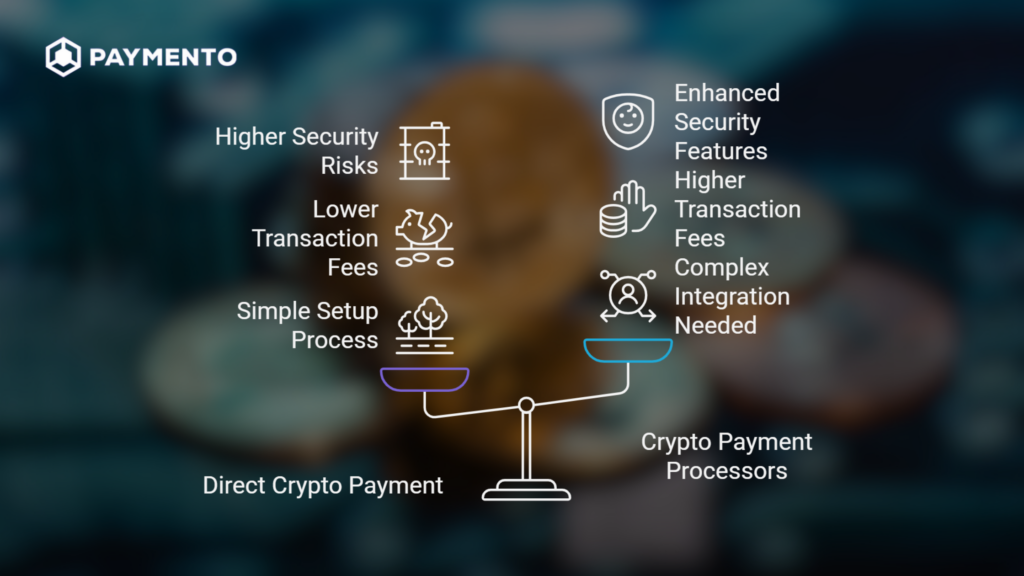

Two Ways to Accept Crypto Payments on Your Website in 2025

Direct Crypto Payment

This method involves sending funds from one crypto wallet to another. Usually, you generate a unique QR code for your wallet address and send it to your customer or display it in your walk-in store.

Your customer scans the code and enters their unique private keys to complete payment. After validation, you receive your funds, and the transaction is permanently stored on blockchain technology.

Pros: No central authority guides transactions, so you have total control of your funds. You can forget the need for intermediaries such as centralized payment gateways, giving you all the privacy you need.

Also, you save up more as direct crypto payments cost little to no fee (peer-to-peer transactions), while centralized financial institutions charge between 2-3%.

Cons: Direct peer-to-peer transactions require your efforts and time to initiate, track, verify, and confirm transactions, unlike crypto exchange platforms, which do all the dirty work for you. Converting crypto funds to fiat currencies like USD or EUR requires manual effort.

Because you have to do everything manually, there is a possibility of you making mistakes with either the payment amount or recipient wallet address, which cannot be reversed, unlike centralized financial institutions.

Crypto Payment Processors

These third-party payment systems serve as middlemen and process payments on your behalf. They convert crypto funds into fiat currency if needed and usually charge a minimal fee for each transaction, saving you the manual effort of doing everything yourself.

Register with a crypto payment gateway like Paymento, Bitpay, or NOWPayment. Your customers pay using the gateway’s payment system, and you get funded in crypto or fiat.

Pros: Third-party payment processors are easy to use and integrate into online stores like Shopify, WooCommerce, and WHMCS. They automate customers’ payment processing from invoicing to confirmation and immediately convert funds to fiat if prompted. You won’t need to do anything manually.

Unlike direct peer-to-peer payment, payment processors handle all stages of transactions and reduce errors. They also provide customer support for complaints, boosting customer trust and satisfaction.

Cons: Some crypto payment systems require KYC (know-your-customer) verification, which requires submitting documents containing personal data such as ID cards. This is not ideal for businesses that need privacy.

Third-party payment processors often have limitations with the number of accepted cryptocurrencies and charge a minimal fee ranging between 0.5% to 1.5%, reducing transactions’ profit margins.

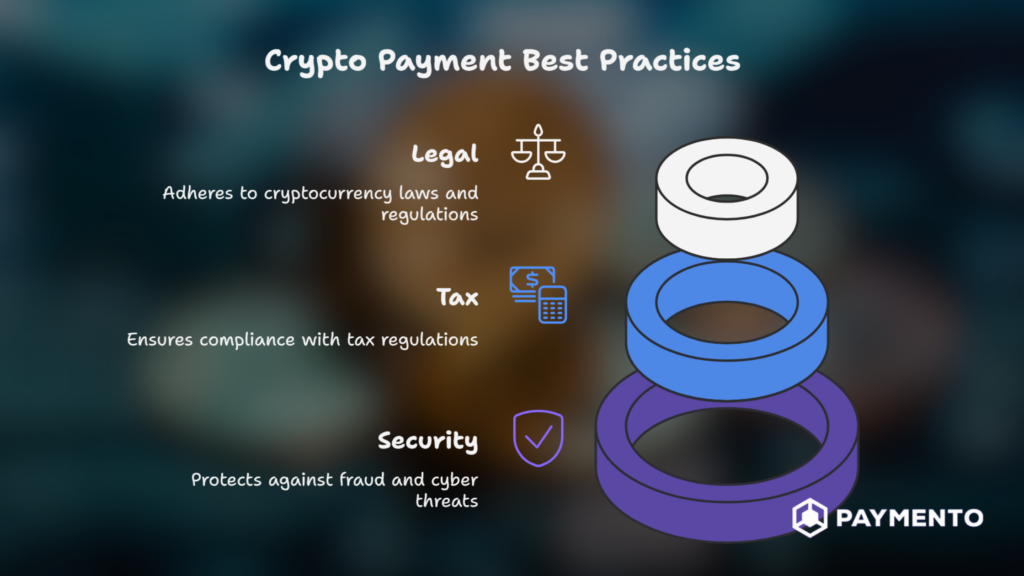

Security, Tax & Legal Best Practices for Accepting Crypto

Accepting crypto payments on your website can boost security, reduce transaction fees, and widen your reach globally. Still, it is crucial to ensure that your business follows all security, tax, and legal best practices. Here are the vital ones to follow:

Security Considerations

- Private keys are the passcodes for completing transactions and accessing funds. Store them safely and never disclose them to anyone. Protect your keys by opting for cold wallets that allow offline storage. Trezor, Ledger, and Safepal are great examples.

- It allows multiple-signature wallet authorizations, especially for businesses that have numerous stakeholders.

- Add the Two-Factor Authentication (2FA) as an extra layer of security for login verifications.

- To reduce vulnerabilities, regularly update your business software, such as your wallets, plug-ins, and gateway software.

- Set up transaction monitoring and suspicious activity detection systems to avoid fraudulent incidents.

Tax Considerations

Depending on your location, some tax laws may affect your crypto dealings and profit margins. For example, the Internal Revenue Service (IRS) in the U.S considers crypto an asset, not just a currency. Businesses must report profits and losses whenever crypto is exchanged for fiat or services.

Some other ways your crypto transactions may be taxed include the following:

- Capital Gains Tax: This applies to crypto funds you keep for some time and sell at a profit.

- Income Tax: Charged on crypto-to-fiat conversion transactions.

- Value-Added Tax: Consumption tax charged when goods and services are purchased.

Depending on your region’s jurisdictions, tax authorities may need a detailed payment record for audits and compliance. You must keep track of transactions’ date, time, amount, cryptocurrency, and wallet addresses.

Legal Considerations

Before adopting cryptocurrency as a payment option, you must confirm the legal licenses and documentation required by your country’s jurisdiction.

The European Union, for example, requires businesses to comply with the Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

If your business is subject to jurisdictions like this, you must integrate the required KYC and AML verifications into your payment system, especially for large transactions.

Finally,

Accepting crypto payments on your website is something you should consider, and it has been made very easy. Not only will it broaden your global reach, but it will also skyrocket your profit margins. You get to enjoy instant crypto settlements and cross-border transactions with little to no fees.

To ensure smooth payments on your website, you can display real-time cryptocurrency prices, offer stablecoins for reduced volatility, and clearly state your refund policies, as crypto transactions cannot be reversed.

Once you’ve integrated crypto payments on your website, include a visible button showcasing your new payment option and periodically offer discounts.

So, are you ready to start accepting crypto payments on your website? Get started with Paymento today, the best crypto payment gateway in the game—fast, secure, and low fees!

Frequently Asked Questions (FAQs)

What are crypto payments?

Crypto payments are digital payments made with cryptocurrencies in exchange for goods and services.

Which crypto is best for payments?

The best cryptocurrencies for digital payments are USDT, Bitcoin (BTC), Ethereum (ETH), USDC, Solana (SOL), and Ripple (XRP), among others.

What is the best crypto payment gateway?

Paymento is the best non-custodial crypto payment gateway with no KYC verifications. It offers instant crypto settlements, and rypto-to-fiat conversions. Charges 0% on your first $25,000 transactions, and a low fee of 0.5% on future transactions.

Are crypto payments traceable or untraceable?

Crypto payments are traceable. Most cryptos are powered by a public ledger system, which ensures transparency. Thus, all transactions can be traced using a user’s wallet address.

Are crypto payments trackable?

Crypto transactions can be tracked with a wallet, a node, or a blockchain explorer website.

Can Stripe accept crypto payments?

Yes. Stripe’s ‘Pay with Crypto’ lets you deposit stablecoins as fiat in your wallet address with a 1.5% fee.

What are the best crypto payment gateways without KYC?

Paymento and NOWPayments crypto gateways do not require KYC verifications. Paymento has a competitive edge over other gateways as it is decentralized, non-custodial, and provides self-custody wallets, giving you full control of your digital funds.

Can you refund crypto payments?

No, crypto transactions are irreversible and, therefore, cannot be refunded.

Who accepts crypto payments?

Microsoft, Starbucks, Overstock, Twitch, NameCheap, Gyft, Home Depot, AT&T, Whole Foods Market, Shopify, Express VPN, Paypal, AMC Theatres, etc.

Who verifies payments on the Bitcoin network?

Miners verify transactions on the Bitcoin network by solving cryptographic mathematical problems.