Crypto Payment Gateway: What It Means, How It Works, Key Features and Benefits

The web is constantly evolving, and so are businesses and payment methods. Web3 and cryptocurrency adoption are massively transforming the financial industry. Companies that will thrive with this evolution continually seek ways to adapt, including selecting the ideal crypto payment gateway to integrate into their online stores.

According to Tripple A research, the global crypto payment gateway market is on a rapid growth trajectory. With over 500 million people adopting cryptocurrencies globally and 65% of the population willing to make payments with cryptocurrencies, the market size, valued at $1.4 billion in 2024, is projected to reach $5.4 billion in 2032, with an annual growth rate of 18.7%.

Source: https://www.triple-a.io/

This remarkable increase in crypto payments adoption, surpassing conventional payment gateways with an annual growth rate of 99%, proves that businesses are capitalising on this growth opportunity. All customers’ needs are met regardless of their payment preferences, and companies do not lose more money.

This article will discuss the crypto payment gateway, its meaning, major features, how it works and the benefits it can offer your business. Without wasting time, let’s get to it.

What is a Crypto Payment Gateway?

A crypto payment gateway is a payment processor that accepts virtual currencies and converts them to fiat currency. Unlike traditional payment gateways, which accept fiat funds, crypto payment gateways receive cryptocurrencies such as USDT, Bitcoin, or Ethereum and convert them to cash instantly deposited into bank accounts.

Crypto payment gateways allow business owners to offer customers payment alternatives. They serve as intermediaries between merchants and customers, making it easier for merchants to receive crypto payments in exchange for goods and services without investing time in monitoring and trading their crypto funds.

How Does a Crypto Payment Gateway Work in 2025?

Payment Gateway Integration

Activating a crypto payment gateway begins with choosing an ideal one for your online store. Then, integrate it into your store through low-code offerings such as the payment gateway’s API(s), plugins, and payment pages.

The integration process can take 2-4 weeks, depending on your expertise and internal resources. In-store payments are processed using a physical card-reader-like device integrated with POS systems.

Payment Initiation

After negotiating on a product, customers decide to buy, and a price is concluded for the product. Then, customers proceed to check out. The crypto payment gateway is opened through a virtual link (in-app and web), API interface, or an in-store integrated POS device for payment.

Payment Request Generation

Accepted digital currencies are presented with their current market price, and customers choose their preferred cryptocurrency. The payment request containing the specific amount of crypto funds is sent to the payment gateway, which generates a unique wallet address for payment. For in-store customers, a QR code is placed on the counter for easy scanning and payment completion.

Payment Confirmation

Once transactions are processed and verified, the details are encrypted and added to the transaction chains on the blockchain network, guaranteeing their immutability and transparency. After confirmation, both the merchant and the customer are notified of a successful transaction.

Payment Conversion and Deposit

Crypto payment gateways send crypto funds to the merchant’s wallet depending on their payment preference. Some centralised payment gateways convert them to fiat currency before funding the merchant’s authorised bank account. Depending on the payment platform used, this conversion can take days or be instant.

Key Features of a Crypto Payment Gateway

Decentralization

Crypto payment gateways are built on blockchain technology, a system that encrypts and distributes data across a global network of computers (nodes) and permanently stores it. Therefore, transaction details recorded on a crypto payment processor are decentralized, immutable, transparent, and traceable.

Security Measures

One key concern with online transactions, especially with cryptocurrencies, is security. However, crypto payment gateways have robust security measures to protect transactions. These measures include multifactor verification, multi-signature wallets, and complex encryption protocols, which provide a high level of security and peace of mind for merchants and customers.

Peer-to-Peer Transactions

Due to their decentralised technology, crypto gateways foster peer-to-peer (P2P) transactions, eliminating the need for banks, government regulations, and other intermediaries required in conventional financial institutions. This way, transactions are more affordable, swift, secure, and efficient than traditional bank transactions.

Unrestricted International Transactions

Merchants and retailers with international clients often face payment restrictions due to their region’s financial regulations, which can decline business growth. Crypto payment gateways solve this problem by processing international transactions while charging low fees.

Not only that, conventional banks often take 5-7 working days before international payments are processed. Crypto gateways process payments instantly, regardless of the location of both business parties.

Real-Time Funds Exchange

The crypto market is volatile, and price fluctuations are bound to occur depending on traders’ and industry leaders’ decisions. Crypto gateways process digital currencies’ conversion to fiat funds with real-time prices, and transactions are completed within seconds of initiation.

Multi-Device Compatibility

Crypto gateways are compatible with all devices and operating systems. Users do not need to update their device configurations to integrate gateways, as they are functional on all devices, including iOS, Android, and Windows.

Benefits of Using a Crypto Payment Gateway

Ease of Use

Excellent payment gateways like Paymento.io are designed with user-friendliness in mind, making website integration easy. Their simple user interface and straightforward integration process, often requiring just the installation of a plugin or the generation of an external payment link, provide reassurance that you don’t need extensive technical skills to start using crypto payments.

Worldwide Market Reach

Cryptocurrency gateways are positively influencing the global e-commerce landscape. They foster business growth by allowing retailers and merchants to carry out transactions outside their borders. Unlike traditional banks, which require official documentation and several days to complete transactions, crypto gateways eliminate this process and complete transactions in seconds.

E-commerce owners leveraging crypto gateways have better chances of attaining greater financial heights since they can easily tap into the international market without any hitch and skyrocket profits.

Lower Transaction Fees

Let’s face it: The conventional bank transaction fees for financial services can be overwhelming. Some include monthly maintenance, outside-of-network ATM fees, overdrafts, wire transfers, bank statements, dormant accounts, and account closing fees.

Traditional banks charge customers for everything. However, with advanced Web3 solutions such as the crypto payment gateway, which charges lower fees, businesses can save money while making larger transactions worldwide.

Data Privacy

Crypto gateways leverage blockchain technology’s prominent features—immutability, decentralisation, and transparency—to ensure transaction privacy and security and reduce the occurrence of scams and hacks.

In a digital world where privacy is the new currency, payment gateways provide data privacy by encrypting customers’ data and transaction details. This fosters customers’ trust and loyalty.

Swift Conversions

Cryptocurrency transactions are completed immediately after initiation. This eliminates the risk of slippage, a sudden drop in the market value of a token during a pending transaction.

Also, instant currency conversions and fund deposits increase customers’ satisfaction and improve businesses’ financial flow, as funds can be invested in other stocks, assets, or industry opportunities.

Payment Alternative

Cryptocurrency gateways allow businesses to broaden their payment options. This will help them gain a competitive edge over industry competitors and attract a larger customer base, including people who prefer cryptocurrency payments.

Common Challenges with Crypto Payment Gateways

Cryptocurrency Volatility

Cryptocurrency is widely known for its high profits and losses. The crypto market is highly dynamic due to crypto traders’ constant ‘buying and selling’ decisions, which are usually based on the latest online trends and news.

This continues to challenge crypto gateways, as price stability is required for businesses to exchange value for goods and services.

Payment gateways embed some safeguard mechanisms to minimise volatility, such as offering real-time currency conversions, accepting stablecoin and a wide range of cryptocurrencies, and following risk assessment protocols.

Regulatory Challenges

There are controversies and legal complexities surrounding the regulation of cryptocurrencies. Gateways must navigate the different regulatory laws guiding financial transactions in various regions globally. Some measures are created to minimise this risk:

Customer Identity Verification

Financial institutions, including centralized crypto payment gateways, must integrate the ‘Know Your Customer’ (KYC) and ‘Anti-Money Laundering’ (AML) regulations into integrated financial security systems.

Some centralized gateway users verify their identity with personal information. Centralized gateways verifications require legal ID cards, and utility bills—usually for address confirmation. This way, scammers and individuals with malicious intent are denied access to the payment platform.

Legal License Acquisition

Acquiring a legal license isn’t compulsory to start a cryptocurrency payment gateway but may be required by some jurisdictions. For those that do, systems are in place to get a legal license for cryptocurrency-related activities.

In the US, crypto founders are required to register as financial services providers and acquire their legal license by submitting vital documents, including a business overview, project team details, a business plan, and most recent bank statements.

Data Protection Regulations Compliance

Crypto gateways and other crypto-related platforms must follow the data privacy regulations jurisdictions provide. For example, the European Union General Data Protection Regulation (GDPR) guides all European organisations’ data protection practices.

Security Risks

The greatest challenges for cryptocurrency platforms are frequent hacking attempts and cyber attacks. Crypto payment gateways face many security threats, so keeping customers’ information and funds safe is their priority.

To minimise this threat, payment gateways integrate rigorous security measures such as data encryption, multi-factor verifications, and intrusion detectors. They also leverage machine learning algorithms to identify and eliminate malicious threats.

Integrating a Crypto Payment Gateway Into Your Website

- Choose the right payment Gateway: Review available payment gateways, note their accepted cryptocurrencies, and ensure they contain your customers’ preferred options. Other things to consider are transaction fees, customer care support, ease of integration, embedded security measures, and, most importantly, reviews and feedback from previous users.

- Sign up: Follow all required steps to register on the payment gateway platform and provide the needed information for KYC verifications.

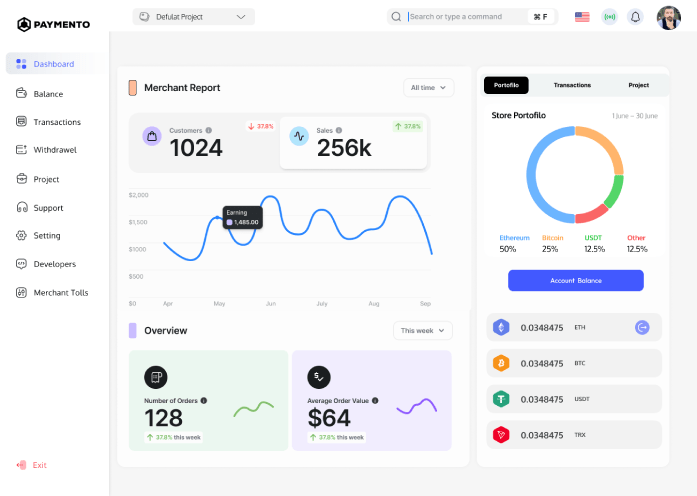

- Account customisation and API keys: Sign in, access the dashboard, and make your desired changes—transaction limits, digital currency options, or notification personalisation. Afterwards, locate and save your API keys.

- Website integration: Depending on your business needs, you can choose between payment pages, APIs, and plugins (WordPress websites) integration methods. Payment pages divert customers to the crypto gateway payment interface, while APIs let customers make payments on your website. Popular examples of APIs are the Woocommerce and Stripe payment processors. Once a decision is made, input your previously saved API keys on your website according to the directions provided by the payment crypto gateway.

- Gateway testing and deployment: After integration, use the transaction testing simulations provided by your payment provider and look for errors that can affect future transactions.

- Get started: Once the simulations are over and errors are ruled out, you can start making actual transactions. Continue to be on the lookout for early issues detection.

Why Should You Choose Paymento?

Purchasing products online shouldn’t be that difficult, and international transactions shouldn’t be a hassle. However, traditional banks’ protocols, rigorous verifications and excessive fees complicate these transactions, delaying payments for days or weeks.

Paymento is here to fix that.

We are the first non-custodial crypto payment gateway with a DeFi-based ‘buy now, pay later’ (BNPL) financial service. Because we are non-custodial, regulatory compliance risks are decreased. Additionally, outrageous fees for wallet-to-wallet transactions and payment intermediaries are eliminated.

We are here to lead the Web3 revolution by creating a fully decentralised future where everyone can participate, you included. You can make global transactions with virtual or fiat currencies and get credited instantly with lesser fees. Our payment gateway accepts over 4000 crypto assets, catering to your entire customer base, regardless of their digital payment preference.

You ultimately control your funds with your private wallet keys, removing the need for third parties like wallet providers and Crypto exchangers.

Some crypto wallet providers and exchangers give official organisations access to users’ KYC and AML details for routine checkups, leaving users prone to hacks, data breaches, and fund loss. With Paymento, your funds are highly secured. You alone can access your wallet’s keys, ensuring privacy and security.

With our ‘buy now, pay later’ solution in development, your future transactions are flexible. You will be able to borrow funds from DeFi lending protocols, purchase products, and pay back at a more convenient time. However, to gain early access and benefit from this solution, you must integrate Paymento into your store now.

Our simple interface design, easy-to-integrate API, no-code plugin offerings, and removal of KYC verification struggles make Paymento the best option for your business. Contact us today to learn more about our services and how your business can benefit from them.