Why Smart Businesses Are Switching to Crypto Payments (And Why You Should Too)

When Amazon, Microsoft and other future 500 start accepting crypto payments in the next few months, what will your business do? What if the payment option that will save you thousands of dollars a year is the one you haven’t even considered adding to your checkout?

Imagine: you are a successful online retailer doing $100,000 a month in international sales. Each of those transactions is run through traditional payment processors and is costing you a fee of 2–4% of the total transaction, along with extra fees associated with currency conversion, and charging back fees. That’s upwards of $4,000 burned every month—money that could be put to use in growth, marketing, or towards your bottom line.

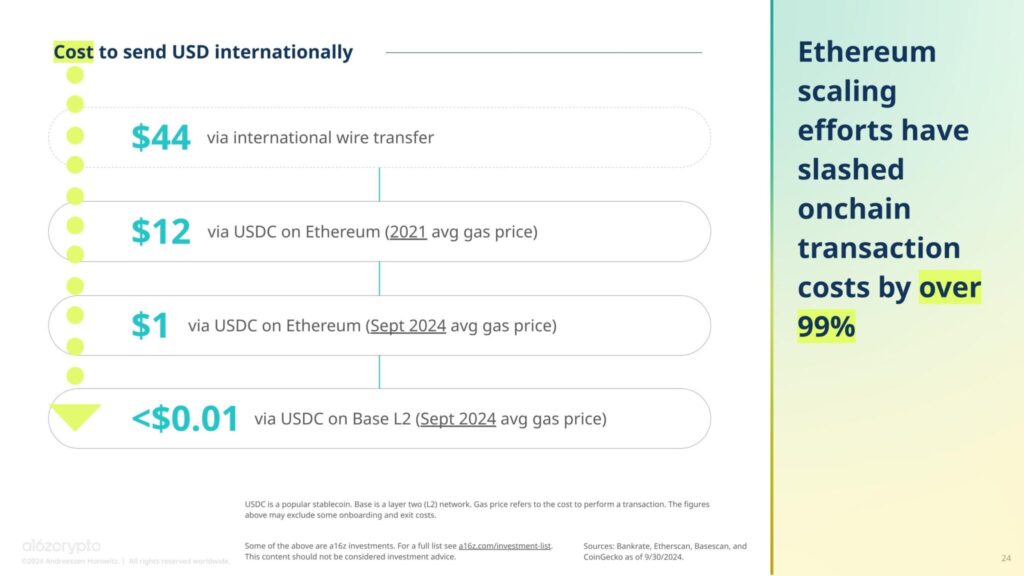

Meanwhile, a competitor starts to accept crypto payments that are powered by stablecoins like USDC. This competitor is sending transactions through the blockchain for <1% in fees, has instant access to the funds, and is expanding into global markets without worrying about bank hold times and cross-border barriers. As customers continue to ask for alternative payment methods, do you know which business is likely to win their loyalty?

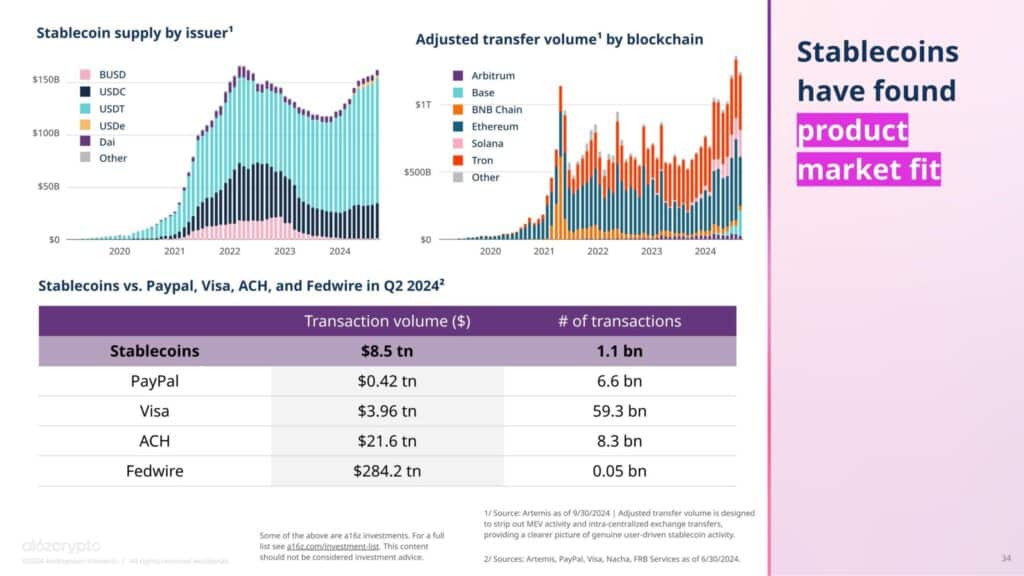

This is not science fiction. It is happening. Stripe, PayPal, and Visa are already in beta testing stablecoins. Other retailers of fortune are quietly getting ready to market digital currency payments for the approaching tipping point.

From Experiment to Something Mainstream: What Makes 2025 Different?

For years, cryptocurrency has been considered the next big fad, and the speculation bubble around it being a potential asset class for venture technology but today, the trend line looks different. Bitcoin, once valued at $350, now trades above $118,000, and it will no longer even be considered a question of whether crypto assets are part of an institutional portfolio. It’s no longer a trend; this is part of the new structure for our global economy.

All types of institutions are taking notice, both private and public. Institutional investors with trillions in assets (like BlackRock, Fidelity, and Morgan Stanley) have now created Bitcoin products for their clients. Additionally, some governments are now looking at Bitcoin reserves and national crypto strategies; when ultra-wealthy organizations (and countries) allocate capital, it is no longer a question of if we will be adopting crypto it is more of a question of how fast it will happen.

The regulatory environment was a major barrier for businesses, but shifted significantly. Governments have moved from hostility to active support and regulation, introducing stablecoin frameworks and licensing structures that give businesses legal clarity and confidence to adopt crypto payments. This regulatory maturity removes one of the biggest risks that previously kept merchants on the sidelines.

Now major payment platforms like Stripe, PayPal, Visa and Mastercard have all shifted to implement crypto or stablecoin support into their payment transfers. Stripe has even made infrastructure acquisitions for crypto payments, and rumoured to be creating their own blockchain based settlement, which is a wave of a big stick gesture for the governments of the world. PayPal is developing their own stablecoin and recently added in crypto purchases. It is good to note that these platforms are not experimenting; they are adopting because they recognize that the future generations commercial movement will be powered by digital currencies.

For businesses, a new reality is setting in millions of consumers possess Bitcoin, Ethereum, and stablecoins in digital wallets, and they want to use them as easily as credit cards. The first mover advantage for companies that push to launch crypto payment capabilities is going to diminish quickly. Major retailers are going to roll out new crypto payments capabilities over the coming months, and businesses who are late adopters of crypto payment capabilities are going to lose customers to competitors that offer quicker, cheaper, or greater flexible payment methods.

Why Traditional Payment Processing Is More Expensive Than You Think

For a plethora of companies, the cost of payment processing is just a cost of doing business, but if you take time to think through these costs, particularly when it comes to companies that are online or conducting cross border business, you cannot ignore these numbers.

💸 The Real Cost of Legacy Payment Systems

Assuming that you operate an e-commerce store and do approximately $100,000 per month in international sales, you could see firsthand how legacy payment systems derail your revenue.

Credit Card Processing Fees: Generally, 2–4% per transaction, sometimes with fixed fees attached. If we stick to the example of $100,000 in volume per month, you could lose as much as $2,000–$4,000 off the top.

Cross-Border Payment Fees: International cards/customers may incur an additional 1–3%, it is also possible some legacy payment systems would add additional fees. When we consider the interchange fees – it would not be unreasonable to consider an overall fee of 5–10% for every international sale.

Chargebacks and Disputes: When a customer disputes a charge, you and your merchant processor experience a loss. Generally a chargeback usually results in a chargeback fee of $15 to $25, and your time spent managing the chargeback or dispute and potentially lost goods.

Currency Conversion Fees: Generally, when a customer pays with a foreign currency you could be subject to a 1-3% fee for currency conversion, depending on the bank or processor.

Settlement Delays: Payments to merchants could take 2-3 days to settle into their account, which in certain situations can significantly affect cash flow (especially if suppliers and/or team members are expecting a fast payment).

With all these hidden fees, the estimated costs are high especially for businesses taking goods to market across global borders. The fee you thought would be 2% could also be swelled to 5-7% after taking into account everything learned here.

⚡ Crypto Payments: The Faster, Cheaper Alternative

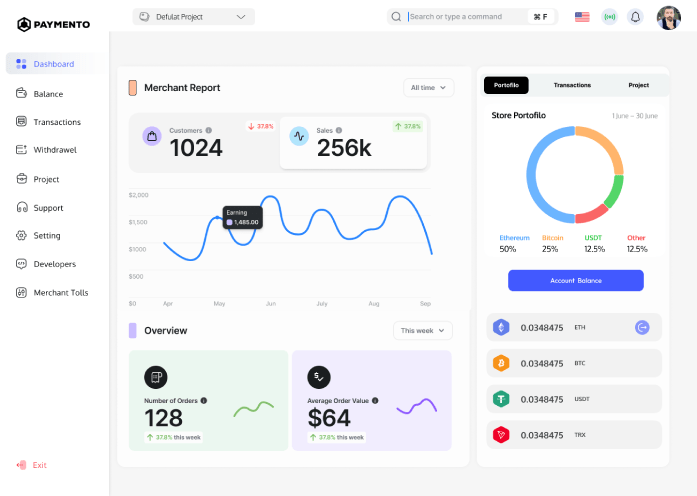

Now we have a mainstream alternative to legacy payment systems in the form of crypto payments that are powered by stablecoins. To date there continues to be significant traction not only for crypto-native businesses, but also traditional businesses looking to improve their bottom line. By utilizing USDC or another stable coin, businesses can accept payments that settle directly to their wallet. There are no intermediaries or waiting for payments to clear, or even worse, having payments delayed by another financial institution. With a payment gateway that is non-custodial like Paymento, businesses can accept payments, control their funds fully and still get the advantages of using digital payments.

🧮 Business Impact in the Real World

Think again about a $100,000/month international e-commerce store.

For a $100K/month business:

| Payment Method | Monthly Cost | Annual Cost |

|---|---|---|

| Traditional (3–5%) | $3,000–$5,000 | $36,000–$60,000 |

| Crypto (≤1%) | $500–$1,000 | $6,000–$12,000 |

Savings: $30,000–$54,000 annually.

This is capital that can be reinvested in things like marketing, hiring, or new inventory. This is really impactful for businesses that have tight margins, or are in competitive markets.

💼 The Bottom Line for Business Owners

Traditional payment processors have been assets for decades, but you need to understand that those systems were never built to function for the internet. For every day that you are locked into these outdated systems, you could be losing revenue, and most the time we don’t even know! Crypto payments, especially payment with stable coins like USDC, are a smarter way to process payments and run your business faster and with much more profitability. Thanks to non-custodial options like Paymento, it has never been easier to get started with this new infrastructure in place, as you have no middlemen, and you won’t have to sacrifice control. The savings are real. The tech is ready. Things are changing.

The only question is, how much longer can your business afford to wait?

Stable coins: The Bridge to Mainstream Adoption

One of the main reasons many businesses have not been able to accept crypto payments is price volatility. Bitcoin and Ethereum can fluctuate double digits in less than a day and definitely not sustainable for businesses looking for predictable cash flow and realizing stable revenue reporting.

This is where stablecoins come in. Stablecoins are unique from traditional cryptocurrencies in that they are pegged to a fiat currency (such as the U.S. dollar), so that anything received as $100 will remain $100 of purchasing power no matter what the market does after the fact.

🏦 Why are Stablecoins Ideal for Businesses?

- Price Stability: Zero risk of a sharp decline in value. Any payment retains the same value as the fiat equivalent.

- Instant Settlement: Funds are available immediately, instead of waiting 2-3 days to receive bank transfers.

- Lower Fees: Processing costs stay under 1%, significantly less than credit card networks.

- Global Reach: Accepted payment from customers all over the world through a single point of acceptance without the need for currency conversions.

- 24/7 Processing: Payments can happen at any time (yes, even the weekends and holidays).

This is the magic combination that allows stablecoins to be the first truly usable form of digital money for mainstream businesses, that has all the benefits of crypto (speed, security, decentralization), without unpredictable pricing.

🌍 The Customer Experience Revolution

The more the mass market gets comfortable with paying with stablecoins without even realizing that it is a type of crypto payment, the faster adoption will take place.

Picture how ecstatic customers will be when making a purchase at checkout that is exactly like PayPal or Apple Pay, but the payment is instant via backend technology through stable coins such as USDC. There are zero delays with banks clearing payments, and no penalty fees for processing or exchange fees between credit cards and forex companies!

Companies that cross over into crypto payments now will be in a position to capture a growing demographic of crypto inclined consumers, but also do a better job of catering to ordinary consumers simply looking for cheaper and quicker ways to pay regardless of the blockchain technology involved.

🔗 Becoming Multi-Chain

Different folks use different blockchain networks for different reasons: speed, transaction costs, wallet preferences, and so forth. Ethereum has the largest ecosystem though it can suffer from high fees. Solana and Tron offer even faster payments at extremely low costs and Layer 2 solutions like Arbitrum or Base are addressing scalability issues.

Smart businesses won’t ride one chain to the ground – they will accept stablecoins across chains and maximize reach and flexibility.

💡 Real Business Impact

Let’s take a think-through an international SaaS company accepting $50,000/month in customer subscriptions:

| Payment Method | Monthly Cost | Annual Cost |

|---|---|---|

| Traditional (3%) | $1,500 | $18,000 |

| Stablecoin (0.5%) | $250 | $3000 |

Savings: $15,000/year

By using a stablecoin-based payment gateway, this company would be saving over $15,000/year while also appealing to lifestyle customers who want to pay in crypto.

🤝 Paymento + USDC: paving the way for global adoption

Paymento has partnered with USDC to enable a stablecoin future with payment acceptance globally.

- Non-Custodial: the merchant’s funds go straight into their wallet. There is zero counterparty risk.

- Global Community: enabling stablecoin payments across multiple chains and payment methods.

- Plug-and-Play Tools: specialized tools for e-commerce plugins and links for payments. This enables all companies from the freelancer to the largest retail to accept stablecoin payments in minutes.

Today, Paymento is removing the middlemen and providing stablecoin acceptance, which ultimately helps businesses embrace a global payment method that is instantaneous and inexpensive, creating the possibilities for mass adoption of crypto.

The Competitive Landscape is Transforming More Rapidly than Ever

The payment industry is experiencing one of the largest transformations since the inception of credit cards. Over the last 18 months, some of the large players in finance and technology have really advanced in grappling with crypto and stablecoin payments, which has impacted customer expectations and the competitors landscape.

🏢 The Big Guns are Moving Fast

Stripe: Made at least 2 crypto infrastructure acquisitions, invested in blockchain-based settlement technology, and is rumored to be testing their own blockchain network.

PayPal: Introduced their own stablecoin (PYUSD) and crypto payments for millions of users.

Visa and Mastercard: Completed USDC settlements, have customer-facing crypto-friendly merchant pilots.

Apple Pay and Google Pay: Have begun to roll out new features in conjunction with crypto wallets.

These entities are not just testing markets or part of a PR play. These are real bets and very tangible moves to put digital currencies in payment boxes of all types in the future.

⏳ The Early Adopter Window is Closing

As these enterprise clients progressively build out new solutions including crypto, there will not be a better time to be an early adopter. Companies that deploy stablecoins as payment now will not only leverage their first mover advantage by:

- Achieving a stratified advantage in the marketplace before customers begin taking crypto payments for granted.

- Claiming and establishing loyalty with crypto native customers that are already completing digital wallet purchase. Having no choice but to go backwards when customers do demand to use it.

To not act now is to risk providing first mover advantage to those that are acting faster to tap into this increasing demand in the market.

🛡️ Why Traditional Processors may not be Good Enough Now

Stripe, PayPal and banks are building out their crypto capabilities, but only in custodial solutions primarily, wherein they are custodians for your funds, settlement and real-time transactions.

Merchants face counterparty risk if their funds are frozen due to fraud investigations or delayed for other reasons. Additionally, the fees charged by traditional processors are often significant enough to undermine the cost advantages that make crypto appealing in the first place.

Geographic compliance doesn’t mean much for true cross-border commerce. This is where non-custodial gateways like Paymento are different; owners keep custody of their funds, can pay lower fees, and can transact anywhere in the world without being subject to the policies or restrictions of a single processor.

⚡ The Empire Strikes Back, but New Players have some advantages

One industry person described the current situation as: “the Rebel Alliance is building but the Empire is about to strike back”.

The “Empire” is all the legacy financial institutions and payment processors racing to get into and control the crypto market. While their entry into the crypto space validates the technology, it provides lots of scope for the emerging, nimble, decentralized solutions to acquire the business of customers looking for:

- Transparency

- Security

- Complete ownership of their funds

- Lower operating costs

By acting quickly, merchants can engage with this new wave of decentralized payments and avoid being locked in to another era of centralized processing with high fees.

Custodial vs Non-Custodial: Why Direct Control is Important for Your Business

When your business is deciding to add crypto payments, one of the most important decisions they must make is whether to use a custodial or non-custodial payment solution. Both custodial and non-custodial options allow customers to pay in cryptocurrencies or stablecoins, but the biggest difference is how each handles the funds on the merchant’s behalf.

🏦 Custodial Payments: A Bank Holding Your Money

A custodial payment processor works like any other bank or traditional payment gateway. Once a customer pays using crypto, the custodial payment provider takes custody of the funds, keeps them in their wallet or account until one of the wallets they own sends the funds to you, sometimes converting itInherent Risks of Custodial Payments:

- Counterparty Risk: The financial difficulties of a provider may result in your funds being frozen, delayed, or even lost in a bankruptcy.

- Delay in Withdrawals: Some services require a settlement window or only provide a limited ability to withdraw in a single transaction, which will affect your cash flow.

- Fees + Mark-Ups: Custodial processors will charge you for your withdrawals, currency conversions, or settlements.

- Limited Routing: Providers will not let you operate in a limited number of countries where they only have regional licensing.

In conclusion, custodial crypto payments are inefficient in an antiquated way to consummate a payment transaction, we simply have the technology to facilitate it quicker.

🔑Non-Custodial Payments – True Ownership, No Intermediary at any time

With Non-Custodial payment solutions like Paymento, your funds will seamlessly flow into your wallet without having to deal with third parties, as you are always able to have total control of your funds.

Advantages of Non-Custodial Payments:

- Instant Settlement – Funds settle into your wallet directly, available in your wallet to be used immediately.

- No Intermediaries, No KYC – Nobody is holding your money or has control over it.

- Lowest Cost – No centrally licensed custodian that marks-up the costs which will result in possible further charges, cost, process, quote and others.

- No Borders – You can utilize your currency without border or licensing restrictions from the provider.

- Amount of Security – Your funds will have much lower exposure to hacks of your counter-party, and even, failure of their operation.

With Non-Custodial, your really will be your own bank, with none of the run-around or headaches. There will be no need to identify how to be a banker as we have tools to make the transaction processing seamless, efficient and easy to use.

🛠️ Addressing the “Complexity Problem.”

Many merchants have preconceived notions of non-custodial being more work, and that this surfacing of complexity will require them to be a crypto-expert.It was once the case, but now technologies such as Paymento allow for some use-cases to be almost as easy as traditional payments:

- Payment Links: Create a secure link or QR code in under 30 seconds – perfect for freelancers or budding businesses, to not have to worry about a full blown website as a way to take payments.

- E-commerce Plugins: Many e-commerce solutions have easy ways to integrate a plugin, including WooCommerce, WHMCS and OpenCart – you can be accepting payments within minutes.

- Multi-Currency, Multi-Chain Support: Paymento and other non-custodial gateways do the heavy lifting of running your whole crypto business, accepting Bitcoin, Ethereum, USDC and many other popular coins from many different blockchains automatically without requiring any other setup.

🌍 Future-Proofing Your Business

The industry is going multi-chain, and Paymento is built to support that future—without the need for re-integration.

🧩 Use Cases for All Business Types

🛒 E-Commerce

- Can use pre-built plugins

- Quick install: 30–60 mins

💼 Freelancers

- Can create links for clients

- Instant settlement

- Avoid PayPal fees

🏪 Retail (Brick & Mortar)

- Can use QR codes at checkout

- No chargebacks

🌐 Global B2B

- Avoid SWIFT fees

- Pay suppliers instantly

🧩 Multi-Asset Strategy

Accept:

- Bitcoin

- Stablecoins (USDC)

- Ethereum, Solana, Tron

And Paymento handle all complexity for you.

⏱️ Quick Setup Timelines

- Full readiness: Same day!

- E-commerce plugin: ~30 minutes

- Payment links/QR: 2–5 minutes

- POS setup: < 1 hour

What’s Coming Next: The Next 12 Months for Crypto Payments

Changes in the payment landscape will happen in the speed of light in late 2023 and through 2024. Crypto adoption is no longer a pipe dream; it is happening now. Businesses that embrace it first will win significantly.

🔮 Short-Term Predictions

Enterprise Adoption Gaining Traction

Large corporations — Amazon and Microsoft, as well as other global retailers — are programming stablecoin payments into their checkout experience. When this happens it will create an industry standard that combines the ease and cohesion of a checkout process with payment flexibility and possible cost.Better User Experience

Wallets and crypto payment solutions are developing rapidly into a user experience that is indistinguishable from traditional payments. Soon, customers will use wallets with stablecoins enabled, without even realizing it involves the blockchain (i.e., in practice everything is a stablecoin).

Greater Regulatory Clarity

Regulations for stablecoins are becoming finalized in governments that will provide clear and regulated, fiat backed assets such as USDC as recognized, accepted and stable payment instruments. This should remove any lingering uncertainty around compliance and security for businesses dealing with customers.

Accepted in Existing Apps

Apple Pay, Google Pay, etc. as well as eCommerce apps will begin to adopt stablecoin support, with crypto payments becoming exponentially easier and more integrated when making everyday purchases.

Increasing Demand from Customers

As consumer wallets and super apps and exchanges continue to bring crypto further into everyday commerce and finance, customers will increasingly expect businesses to provide them with cheaper, faster, borderless options versus credit cards and bank transfer payments.

🧭 What should businesses do now?

Start Small, but Start Now: To minimize volatility risk manage the introduction of compliance in crypto acceptance by establishing acceptance of stablecoins (as an example, USDC) while testing acceptance with your customers.

Learn Together: Invest time in educating your finance and operations teams about how non-custodial crypto payments work and how they can improve cash flow and costs.

Be Multi-Chain: Prepare to accept payments on multiple networks (i.e., Ethereum, Solano, Tron) so that you can maximize reach and support of your customers.

Carefully Monitor and listen to your customers. Use early adopters/early customers as the data learn what payment mechanisms your customers want to use and scale accordingly.

Utilize Decentralized Gateways: Leverage direct systems such as Paymento, where you maintain complete control over your money, low fees, and instant settlement without the risk of a custodial intermediary.

⏱️ Now is the Time to Adopt Early

As Catalini pointed out at a recent industry session, “I think we’re talking months. This is happening at scale. All the leading players, retailers, etc. have a stablecoin strategy, or have been forced to have a stablecoin strategy from the board.”

The transition to stablecoin-payment processing is not in the future, it is right now. Businesses that adopt now will see hard savings on costs, increased efficiency and truly understand what ‘future-proofing’ means for the next 10 years of global commerce.

Conclusion: The Early Adopter Wins

There is no guesswork to the future of payments; it is happening before us! From Bitcoin becoming a thing for the past decade, to the rapid adoption of stablecoins like USDC, crypto payment processing has quickly graduated from a speculative experiment to a practical alternative to using established traditional payment methods at scale.

I can predict in 2025 the question is going to change from “Should my business accept crypto?” to “How fast can we get started accepting crypto?” The cost of waiting and doing nothing will only cost you more—the higher fees, slower settlement times and less opportunities in fast-growing global markets. Acting now brings your business:

- Less friction in customer experience

- Incredible savings on every transaction

- Access to global markets without limitation of legacy banking

- Access to your funds without waiting on third-party lockups

And best of all, you don’t need to be a tech aficionado or have a big internal IT team to start accepting crypto payments. With the non-custodial tools of today like Paymento, you can just grab a simple payment link, plugin to your e-commerce platform, or QR code at physical checkout and get started as early as tomorrow. Just as big enterprises finalize their stablecoin strategies, consumer expectations quickly shift to immediate and borderless payments, early adopters will enjoy the biggest benefits of the innovation.

🚀 Are You Ready to Get Started?

- Evaluate your current payment costs.

- Evaluate how stablecoins might fit into your business.

- Even take it for a test drive with your next invoice, checkout, or client.

Open an account on app.paymento.io, you can start accepting crypto payments the smart way – non-custodial, secure, and ready for the future.